Hurricane Insurance vs. Flood Insurance in Florida: What You Need to Know

By RAMCO Insurance Agency | Helping You Weather Every Storm

🌀 In Florida, Are You Truly Covered for a Storm?

Florida homeowners are no strangers to hurricanes and heavy rains — but many don’t realize that hurricane insurance and flood insurance are not the same thing. At RAMCO Insurance, we often help clients clear up the confusion so they can make sure their homes are fully protected before the next big storm hits.

Let’s break down the differences — and why you might need both.

At RAMCO Insurance, we’re here to help you navigate the many choices available and find the best protection for your home, your family, and your future.

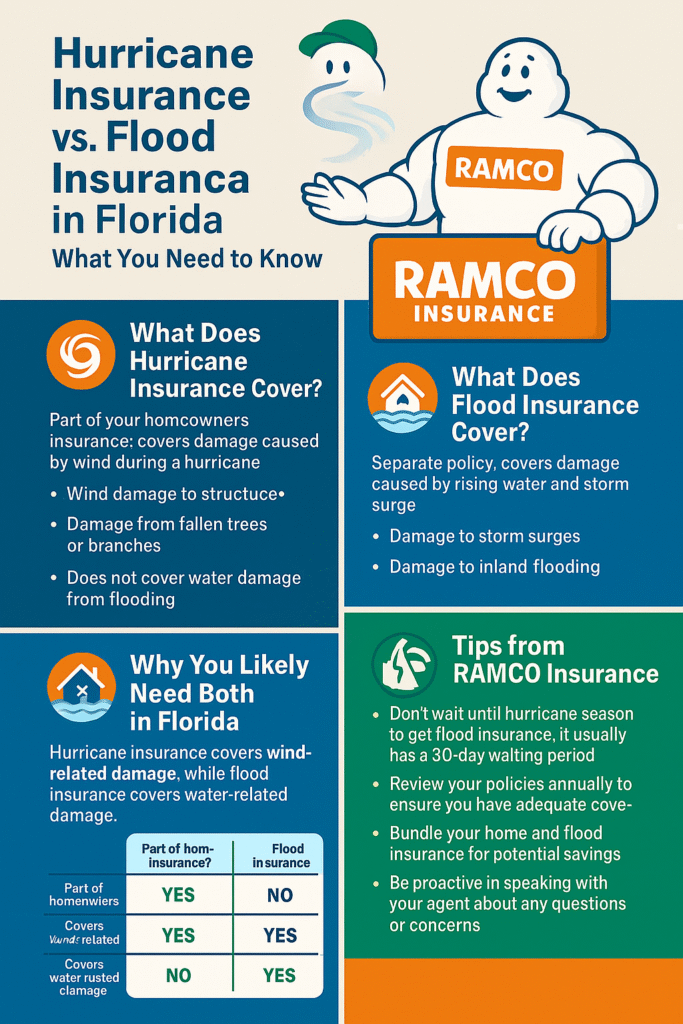

🌪️ What Does Hurricane Insurance Cover?

“Hurricane insurance” is not a standalone policy. Instead, it refers to specific protections within your homeowners insurance that apply when a hurricane damages your property.

Typically, a Florida homeowners insurance policy covers:

- Wind damage to your home’s structure (roof, windows, doors)

- Damage from flying debris

- Damage from fallen trees or limbs

However, this coverage often comes with a hurricane deductible, which is separate and usually higher than your regular deductible. This deductible is triggered only when a hurricane is officially declared by the National Weather Service.

Important: Hurricane insurance covers wind-related damage, not water damage caused by flooding.

🌊 What Does Flood Insurance Cover?

Flood insurance is a separate policy — typically purchased through the National Flood Insurance Program (NFIP) or private insurers — that covers losses caused by rising water.

Flood insurance covers:

- Water damage from overflowing lakes, rivers, and storm surges

- Water intrusion from heavy rain accumulation

- Foundation damage from flooding

- Damage to floors, walls, appliances, and personal belongings due to flooding

In Florida, flooding is the most common and costly natural disaster, yet many homeowners wrongly assume that their regular home insurance will cover it. It does not.

If you don’t have a separate flood policy and your home floods, you’re responsible for the full cost of repairs.

❗ Why You Likely Need Both in Florida

Florida’s unique climate means you’re exposed to both wind and water risks during hurricane season.

Here’s a simple way to think about it:

- If wind tears off your roof, your homeowners/hurricane coverage applies.

- If rising water enters your home from outside, flood insurance is what saves you.

Most major hurricane damages involve both — meaning having only one type of protection could leave you dangerously underinsured.

At RAMCO, we recommend every Florida homeowner consider both windstorm protection (hurricane coverage) and flood insurance for full peace of mind.

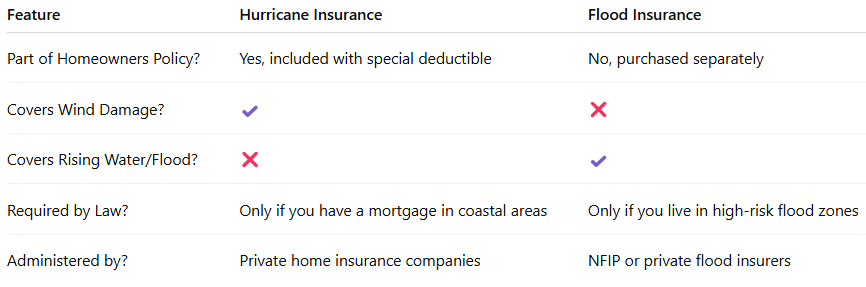

📄 Key Differences at a Glance

💡 Tips from RAMCO Insurance Experts

✅ Don’t wait for a storm warning — flood insurance policies usually have a 30-day waiting period before they take effect.

✅ Review your hurricane deductible and make sure you know how much you’d have to pay out-of-pocket after a storm.

✅ Bundle your coverage smartly — RAMCO can help you find competitive rates for both homeowners and flood insurance.

✅ Stay proactive — Florida’s weather is unpredictable, but your insurance coverage doesn’t have to be.

🛡️ Ready to Protect Your Home from Both Wind and Water?

RAMCO Insurance is your trusted partner for comprehensive protection. Let’s review your policies together and make sure you’re covered from roof to foundation.

📍 Serving Miami-Dade, Broward, and Palm Beach Counties

📞 Call today at (305) 820-0350

📧 Email: info@ramcoinsurance.com

🌐 Request a free home insurance and flood insurance quote at ramcoinsurance.com

Get Your Insurance Quote Now